Tax Exempt for WooCommerce

WooCommerce Tax Exempt provides you a proper system through which you can give tax exemption to selected customers and user roles.

You can enable a customizable tax exemption form on My Account page to let customers submit the required files and other information to claim tax exemption. The store admin can review the submitted info and reject or grant the tax exemption from backoffice.

Once the tax exemption is granted, the tax will be automatically removed from future orders or the store admin can display a checkbox to let customers manually remove tax from each order. The tax exemption details are displayed in order detail pages.

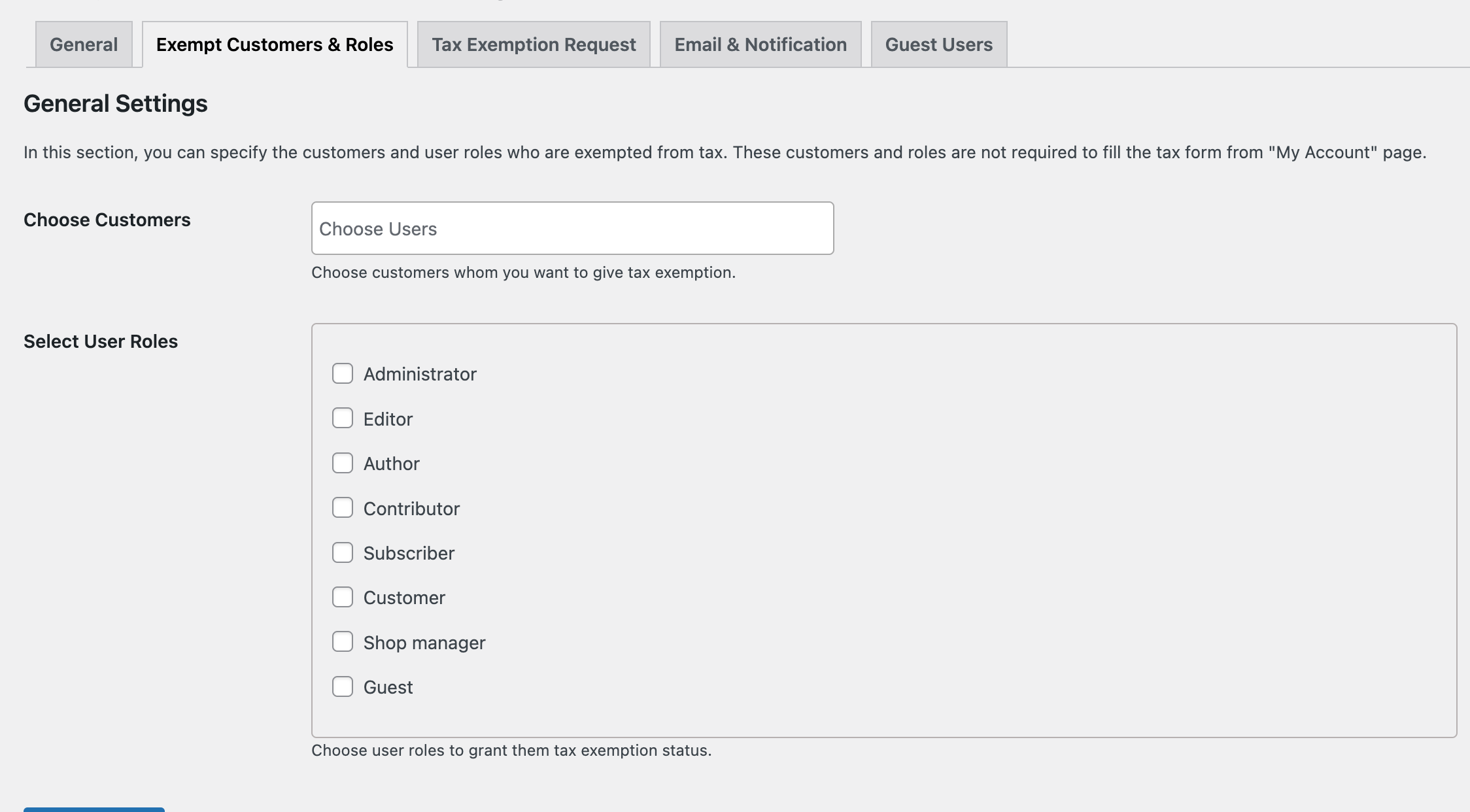

The store admin can also tax-exempt selected customers and user roles. These exempted customers might not have uploaded any tax information from my account but still, they will be able to claim the tax exemption just like the other customers who have uploaded the tax files and claimed tax exemption.

Features List of WooCommerce Tax Exempt:

- Allow all or selected user roles to claim tax exemption

- Display tax exemption form in “my account”

- Customize form fields

- Display tax exemption status in “my account” – pending, rejected or approved

- Review submitted tax exemption requests from the back-office

- Approve or disapprove tax exemption requests

- Add expiry date for tax exemption

- Allow guest users to claim tax exemption

- Grand tax exemption status to selected customers and user roles from the back-office (no need to submit tax info)

- Display tax exemption detail in admin order detail page, customers order detail page, and order email

- Customizable email notifications for admin and customer when

- Tax form is submitted

- Tax exemption is approve or disapproved

- Tax exemption status has expired

- Partially compatible with AvaTax (See details)

How Does It Work?

WooCommerce Tax Exemption plugin enables store admin to grant tax exemption by using the following methods,

Method 1:

Admin can show tax exemption form in the “My Account” page to all or selected user roles. Once a customer submits tax exemption information, the admin can review submitted information from backoffice and approve/disapprove tax exemption request. Once approved, the approval status will be displayed in the “my account” page and during the checkout, a checkbox is displayed to remove the tax from the particular order.

Method 2:

Admin provides the tax exemption to selected customers and these customers can place tax-exempted orders straight away. During the checkout process, they can select the checkbox “Claim Tax Exemption” to remove the tax from the particular order or the store admin can disable this checkbox from extension settings to automatically remove tax from all order of tax exempted customers. (No need to submit any tax exemption information from my account page)

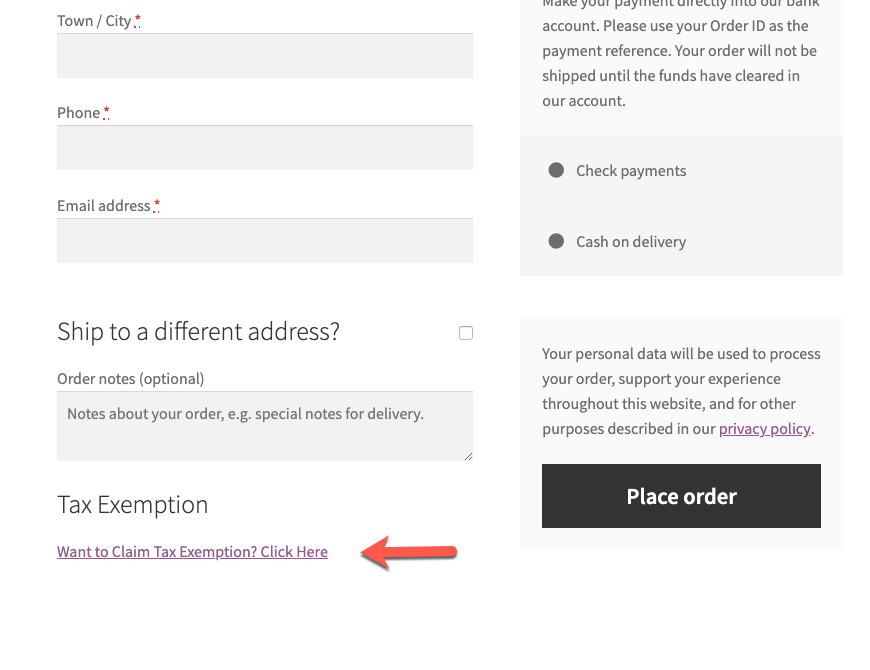

Add tax exempt checkbox on checkout

Once a customer is approved to claim tax exemption, a checkbox is displayed on the checkout page. While placing an order the customer can select the checkbox to remove the tax from the order amount. The store admin can disable this checkbox to automatically remove tax during checkout.

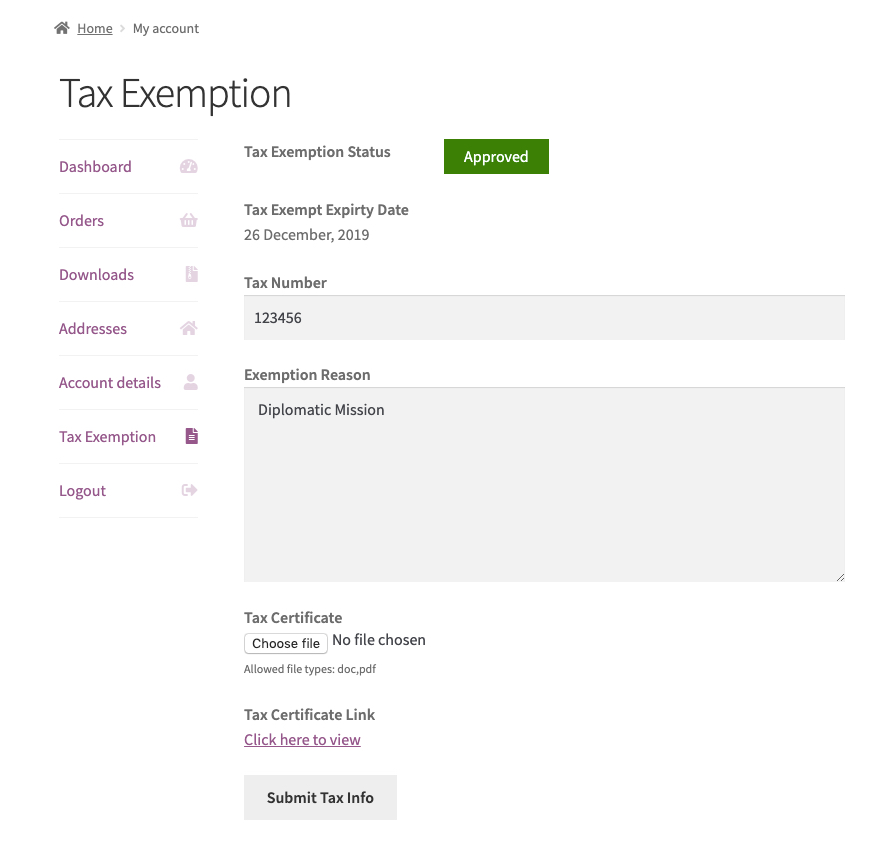

“Tax Exemption” section in my account

WooCommerce Tax Exempt plugin adds a tax exemption form in the “My Account” page. The customers who are eligible for tax exemption can fill the form, provide necessary details and upload tax exemption certificate from the government to request tax exemption. The plugin provides following fields, the admin can customize the label for each field

- 2 Text Fields

- 1 File upload field to accept tax certificates

- Specify the accepted file formats

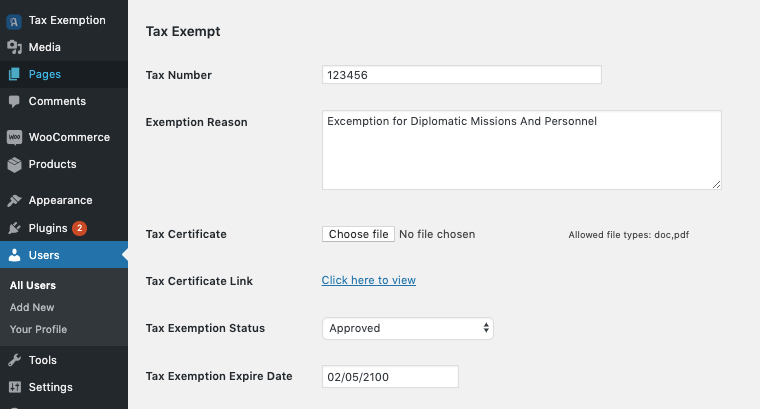

Review tax exemption requests

Once the user submits the tax exemption form, the details will be available in customers’ my account page. The admin can review the submitted details and approve/disapprove tax exemption requests from the user’s detail page. The store admin can also add an expiry date for tax exemption status.

Tax exempt specific customers and user roles:

From the backend configurations, the admin can tax exempt specific customers and user roles. These customers do not need to fill the tax exemption forms from “My Account”. However, the customer can update the tax information at any time from “my account” page.

Tax exemption notice:

You can also display a customizable “claim tax exemption” message during guest checkout to inform the guest customer that tax exemption is available. You can display this notice to both guests and registered customers by user roles.

Email notifications:

It’s a smart WooCommerce Tax Exempt extension that sends automatic email notifications to admin and customers. The merchants can customize the email content for the following email notifications.

- Email notification for customer on successful submission of tax exemption form

- Email notification for admin when a user submits the tax exemption form

- Email notification for customers on approval/rejection of tax exemption requests

- Email notification for admin and customer when tax exemption expires.

Reviews

Clear filtersThere are no reviews yet.